2565 dev

From UG

Contents |

Info

Mantis: 0002565: [Estim P&L] Implement phase 1

Requirements and Solutions

Glossary

Gross Margin report - same as "P/L report".

Estimated Gross Margin = estimated sale minus estimated cost.

Actual Gross Margin = actual sale minus actual cost.

Point Of Revenue Recognition - Point in time (date) when "Sale" for shipment order (CT) is considered complete. It is MOT specific:

- For Ocean LCL and FCL Shipments this date is #Port Of Loading Actual Date

- For Air shipments this date is #Airport Of Departure Actual Date

- For Truck shipments this date is #Actual Export Pick Up Date

Month-end closing - an accounting procedure undertaken at the end of the month to close out that month. In the context of this project and our business it means to compile a "P/L" report that have all CTs with Point Of Revenue Recognition date falling within that month. To make this report meaningful estimated cost and sales numbers for every CT should be present. In this case we will see Estimated total cost, sale and Gross Margin for entire business. Margin will indicate how much money business made (or lost) that month.

Requirements

In a nutshell we need:

- 1) Mechanism to enter estimated cost and sale figures for every CT. Allow for 2 options:

- a) operators enters both cost and sale figures manually

- b) operator enters cost manually and system automatically calculates sales as:

sales = (cost * m%)+ cost

- NOTE: value m should be managed through Admin

NOTE: this will be entered per charge code as usually on TOC

- 2) Mechanism to remind operators about CTs in the system that do not yet have cost estimated (use Dashboard approach)

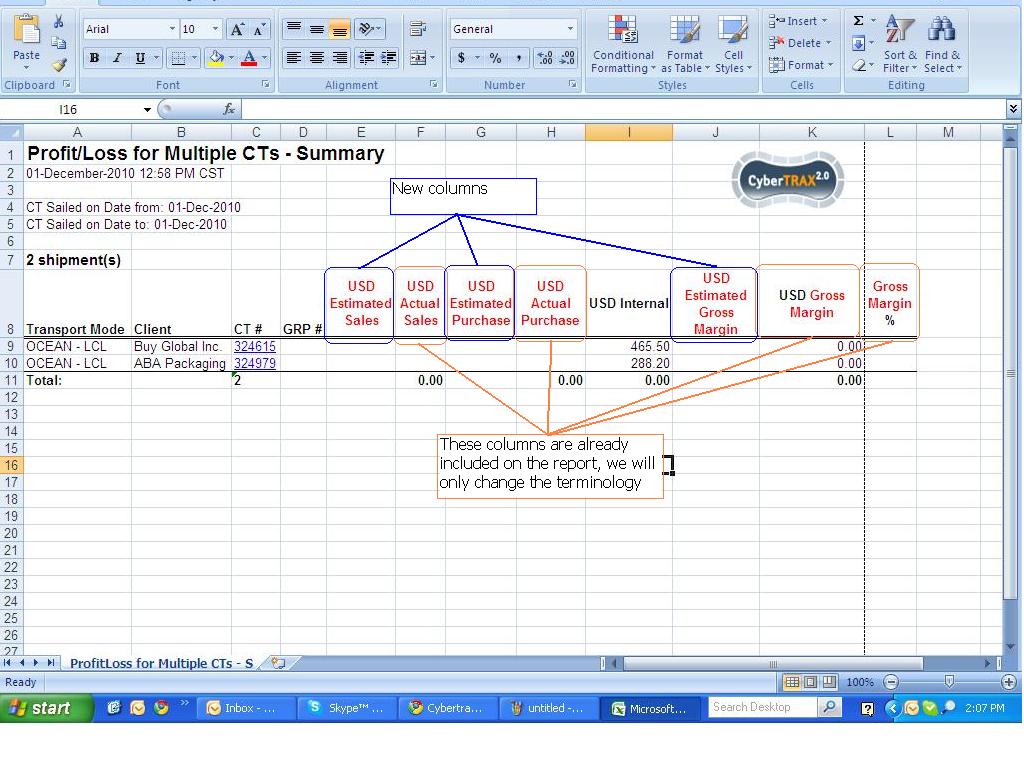

- 3) Add sub-report to Profit Loss for Multiple CTs for Month-end closing (see #Glossary)

Please also note that in the future new "Rates and Costs Tables" will be added that would allow to manage rates in the system. This means that operators would not need to enter costs manually - they could be pulled from the system.

Solution

Estimation for freight charges:

- Pull the estimated sell rate from a database to be entered under the client profile (to be handled on phase 2)

- If nothing is in the database that matches the required information(TBA defined in Phase 2)the system should automatically calculate the estimated sell by:

- Pull cost from a database (to also be handled in phase 2) and add 15% to it. The estimated sell should equal the total of the (cost x 15%)+ cost

- Work around for Phase one - Operators should manually enter cost. The sell should calculate automatically be based on the above calculation.

- If nothing is in the database that matches the required information(TBA defined in Phase 2)the system should automatically calculate the estimated sell by:

- Operators will need to be able to edit the costs and sell and cost or sell estimations manually.

- They should also be able to add and remove lines from the estimation.

Exception:

- Customs Cost's

- Charge Codes beginning with 12 should have no calculation. The sell should match the cost entered. (System should copy same number from cost to sales field).

- The operators should still be able to manually update the cost and sell and the cost or sell.

Estimated Cost

should reflect:

- Dollar Amount

- Vendor

- Currency

- Charge Code

- Charge Code Description

- Total of all estimated Cost entered should be shown

- Currency of the total estimated Cost should be shown

Estimated Sell

should reflect:

- Dollar amount

- Currency

- Charge Code

- Charge Code Description

- Total of all estimated sell entered should be shown

- Currency of the total estimated sell should be shown

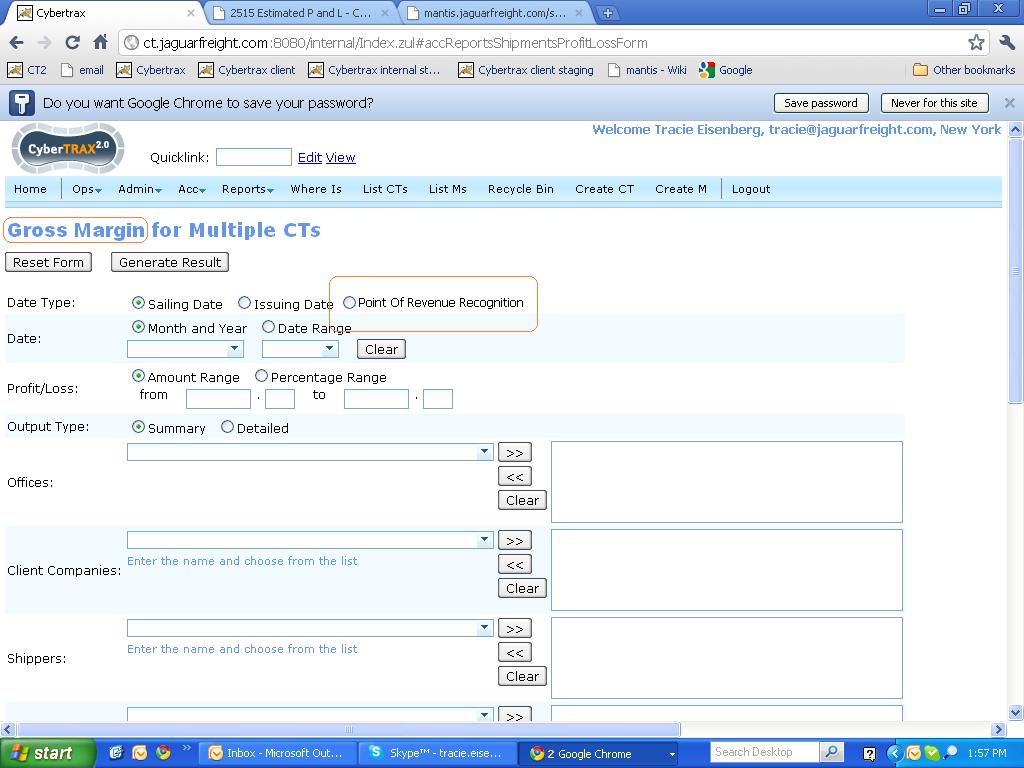

Reports

- Should be able to generate a report showing both estimated cost/sell and actual cost/sell

- The report should be per CT record

- should be within a selected time frame

- should able to download to excel

Dashboard

New type of dashboard panel required.

It should show how many CT records passed Point Of revenue recognition AND are CT is not estimated.

CT is not estimated - grand total is 0 on EstTab.

Dashboard visibility

To identify which operator should have CT posted to this dashboard the following criteria must be met:

- CT records passed Point Of revenue recognition AND

- CT is not estimated AND

- operator belongs to the office that handles the specified region:

- Ct#Airport_Of_Destination/Ct#Destination_Terminal/Ct#Export_Delivery_To_Address belongs to the region defined in Geography>Regions>Office field for this given operator