2653 rfsa

From UG

Contents |

Info

0002653: (Acc Report: Misc) add feature to show total VAT charges separately

Accounting needs a report to show the VAT charges separately and the net amount (amount excluding the VAT charges) for both Sales Invoices and Purchase Invoices. The report should also calculate a total Net Payable or Recoverable.

The total VAT on Sales - total VAT on Purchases = Net Payable or Recoverable.

Business Requirement

The report should have two separate sections

- One section showing all Sales Invoices.

- total at the bottom of all Sales Invoices.

- One section showing all Purchase Invoices.

- total at the bottom of all Purchase Invoices.

Must be downloadable to excel. CT number and Invoice number should be hyperlinks: This can be mapped the same as Acc > Reports > Search Invoices.

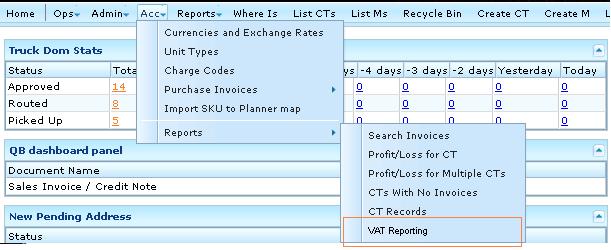

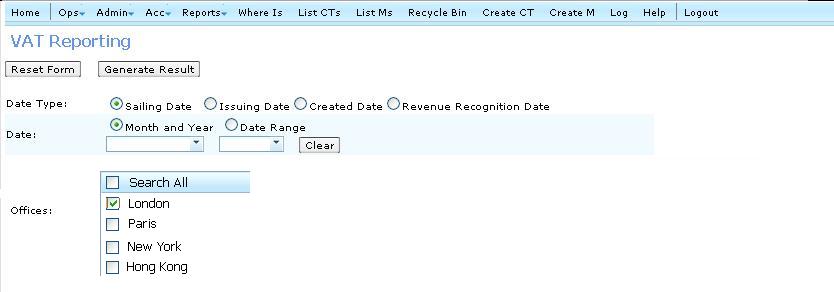

Report Filters

Date Type: (same as Acc > Reports > Profit/Loss for Multiple CT's)

Date: (same as Acc > Reports > Profit/Loss for Multiple CT's)

Offices - So the operator can select one, multiple, or all. (Check boxes have been suggested because it is only 4 choices)

Example

Outputs

output

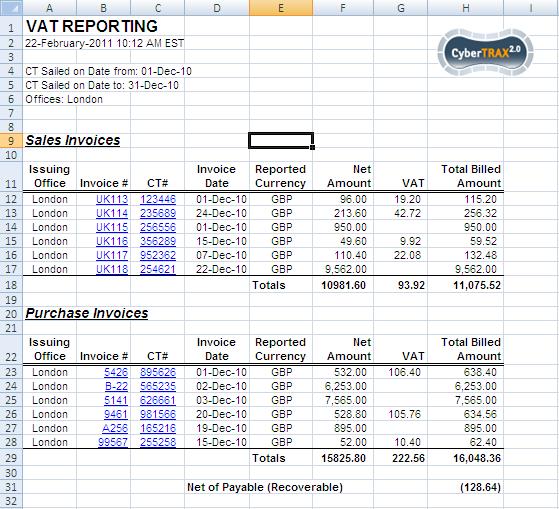

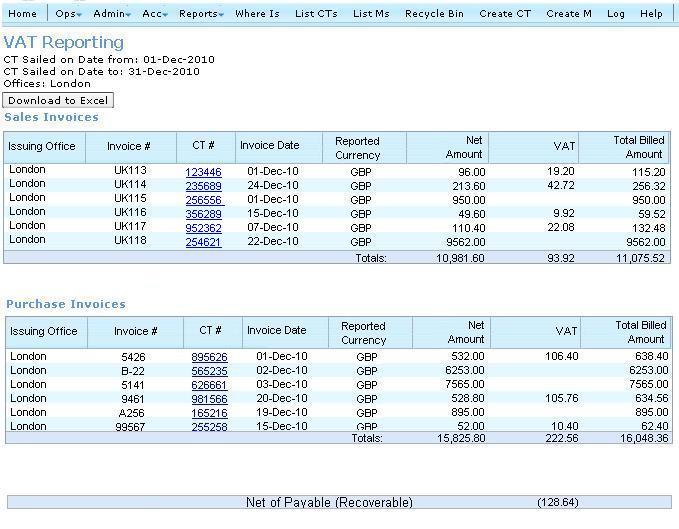

Header should summarize filter options showing

Name of Report

Current Date (or date report was ran)

CT sailed on Month: Full name of month or CT sailed on date from: day-month-year

CT sailed on Year: Full year displayed or CT sailed on date to: day-month-year

Offices: If selected.

Sales Invoice Section

Name of Section: Sales Invoices

Columns:

Issuing Office

Invoice # (as Hyperlink)

CT# (as Hyperlink)

Invoice Date

Reported Currency

Net Amount (total invoiced amount - VAT = Net Amount)

VAT Amount

Total Billed (total invoiced amount)

Note: Net amount, VAT amount, and Total Billed Amount should be totaled at the bottom of the section

Purchase Invoice Sections

Name of Section: Purchase Invoices

Columns:

Issuing Office

Invoice # (as Hyperlink)

CT# (as Hyperlink)

Invoice Date

Reported Currency

Net Amount (total invoiced amount - VAT = Net Amount)

VAT Amount

Total Billed (total invoiced amount)

Note: Net amount, VAT amount, and Total Billed Amount should be totaled at the bottom of the section

Net Payable or Recoverable

This should display the sum of the total VAT in sales section - total VAT in purchase section.

a negative number should be displayed using ().

HTML Output Example

Excel Output Example