2766 rfsa

From UG

Contents |

[edit] Info

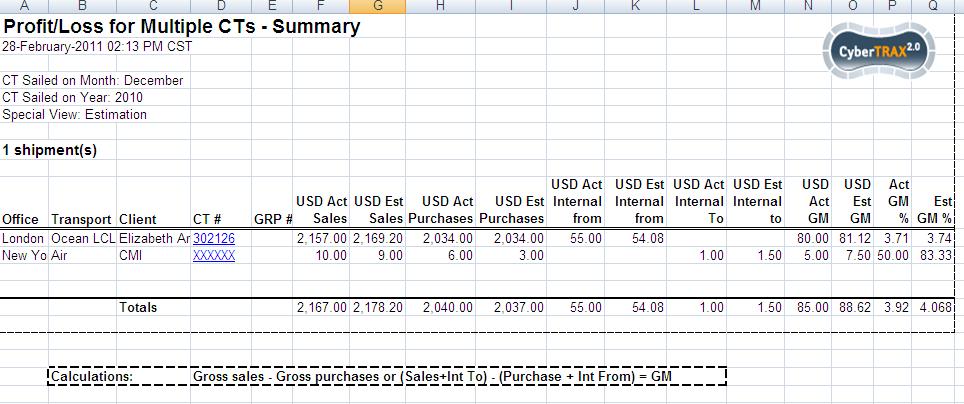

0002766: (Acc Report: Misc) Add a special view to accounting report to show estimation.

Accounting would like a report that would enable them to view estimated charges vs actual charges.

[edit] Definitions and Calculations

GM = Gross Margin

Gross Margin is the total sales revenue minus its cost of goods sold.

example:

(Sales+Internal invoice to) - (purchases+internal invoices from)

GM percent = (total gross margin / total sales (sales+internal invoice to)) x 100 = GM %

P/L = Profit/Loss

- Any P/L or Profit/Loss headings should be replaced with Gross Margin for this report.

- Profit and Loss = is equal to a companies overall profit/loss when calculating overall GM's with operating expenses. So P/L should not be used on a per shipment basis

Profit and Loss = Revenue - ALL Expenses or

Total Sales - (total Purchases+operating expenses)

[edit] Business Requirements

Add an option to the Acc > Reports > Profit/Loss for multiple CTs to include a view of estimation.

- This should not always be included on this report, so this should be like a special view selection or a No Estimation check box that is defaulted to No.

When the estimation is to be included on this report the report should have the following additional columns.

Estimated Sales

Estimated Purchase

Estimated Internal From

Actual Internal From

Estimated Internal To

Actual Internal To Office

The estimation columns should be located next to the corresponding actual column (for examples Actual Sales > Estimated sales>

[edit] Example

Note: The calculation note included on the excel spreadsheet is for additional information - It should not be included as part of the output.