1520 rfsa

From UG

Info

0001520: (P&L) Exclude VAT amount from Profit

It is necessary to exclude VAT charges from the gross margin (P/L) of the shipment. Right now the P/L amounts showing on the P/L tab include the VAT charges in the total. This is making the gross margin or the P/L of the shipment incorrect.

Note: VAT charges that we bill to our customers are deducted from the VAT amount we pay to our vendors. The difference of this is either paid or refunded to or by the government. This is why it is so important to be able to break these charges out and show them separately.

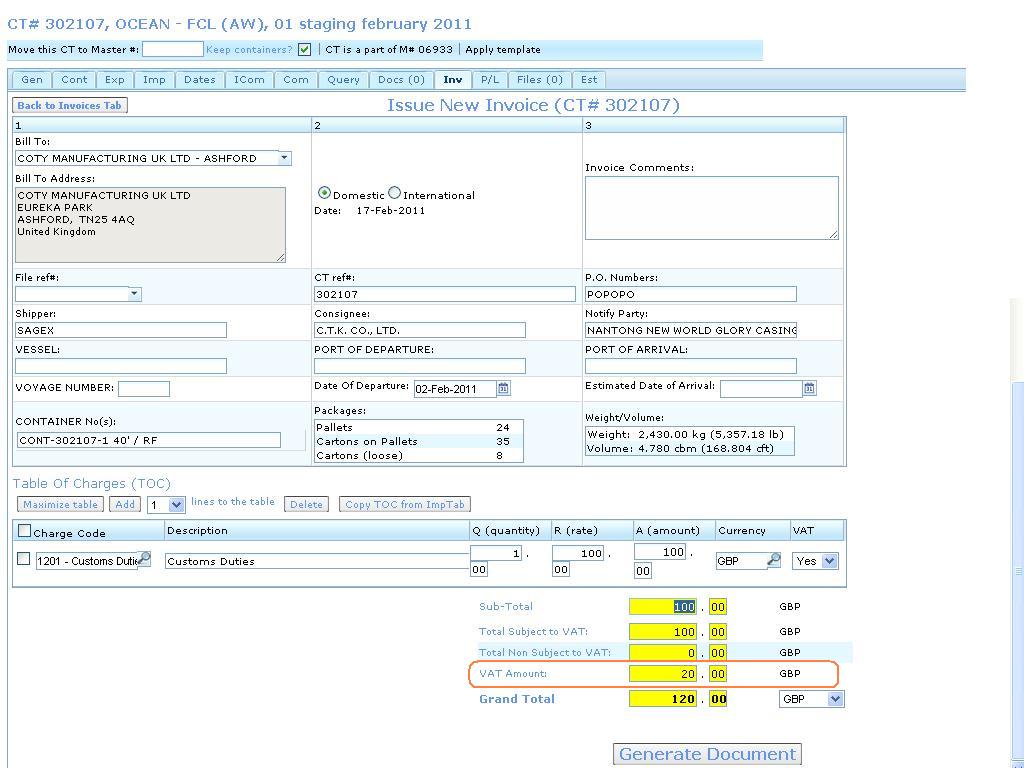

Example:

We invoice Coty 100.00 for Customs Entry and VAT applies at 20% the invoice would show Customs 100.00 Subtotal 100.00 VAT Amount 20.00 Total 120.00

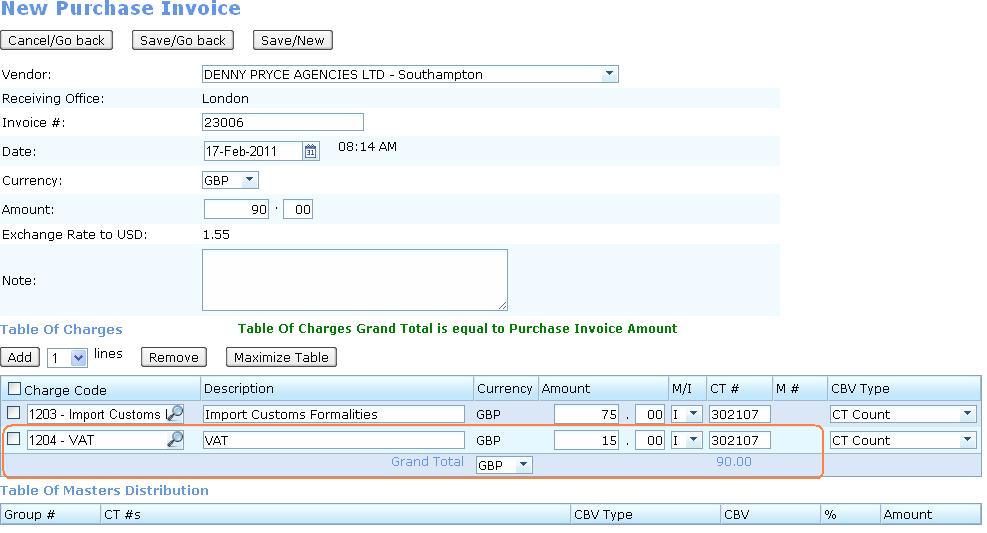

We are invoiced by Denny Price 75.00 for this entry and a VAT amount of 15.00 Customs 75.00 VAT 15.00 Total 90.00

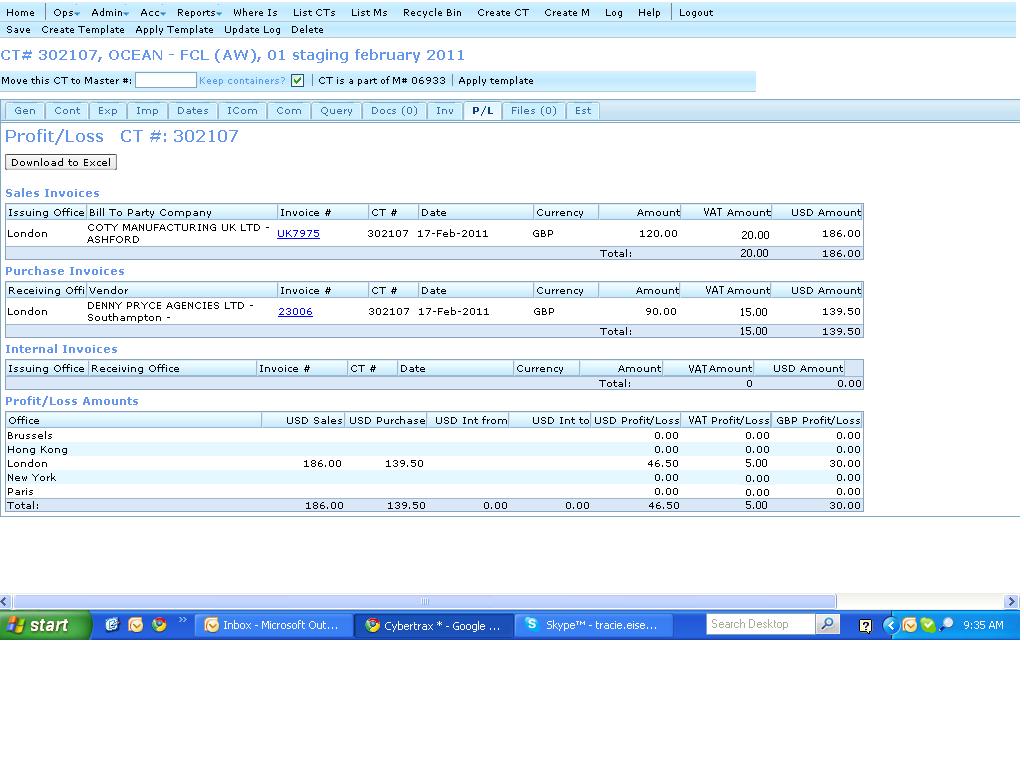

At the end of the tax period we would deduct the 15.00 we paid in VAT from the 20.00 we invoiced and owe 5.00.

Business Requirements

We need to add a column in the P/L tab showing the VAT charges of the invoice.

- for Sales invoices the total VAT listed on the invoice should be shown in this column

- for purchase invoices the total vat entered into this tab under charge code 1204 should be shown in this column.

- for internal invoices VAT should not apply.

- for the profit loss section the difference between the the VAT total of the sales invoice - purchase invoice.

Only the London and Paris offices have the drop down selection to select if VAT applies to a charge, but we need this column to be viewed by all offices.

Note: In the future, we will want to be able to run reports showing this information and we may also need a way to show Customs Duty separately

Examples: