2157 rfsa

From UG

Contents |

Requirements

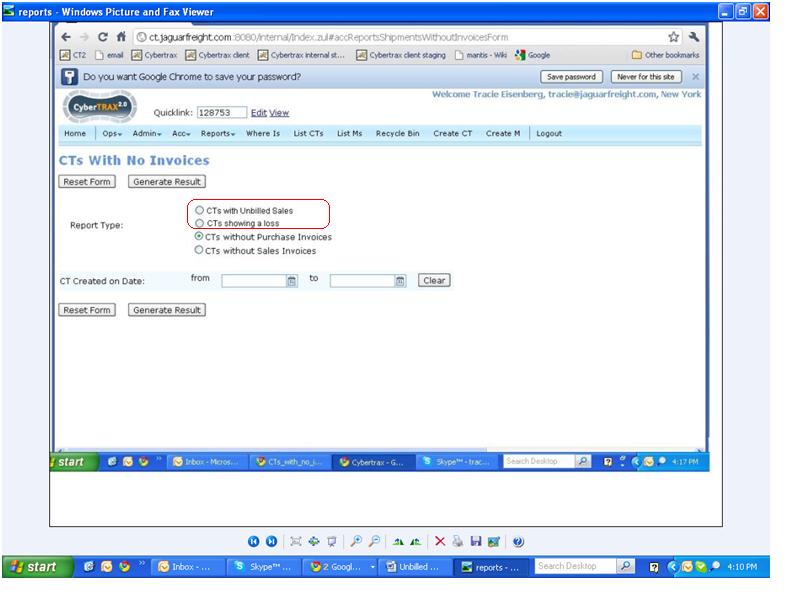

Adding two additional report types.

“CT with Unbilled Sales”

Criteria: CT should appear on this report if: "CT is NOT billed – (If at least one Sales Invoice does not exist (No sales invoice was issued against CT)) AND there is "PI" amount > 0 posted against CT"

- If a CT record does not reflect a purchase invoice against it, it is not required to have a sales invoice against it. If no Purchase Invoice is issued against the CT record, the shipment should NOT show on the report.

- The system should not recognize internal invoices as a sales invoice for this report. If a CT records only has an internal invoice and no sales invoice the shipment SHOULD show on this report.

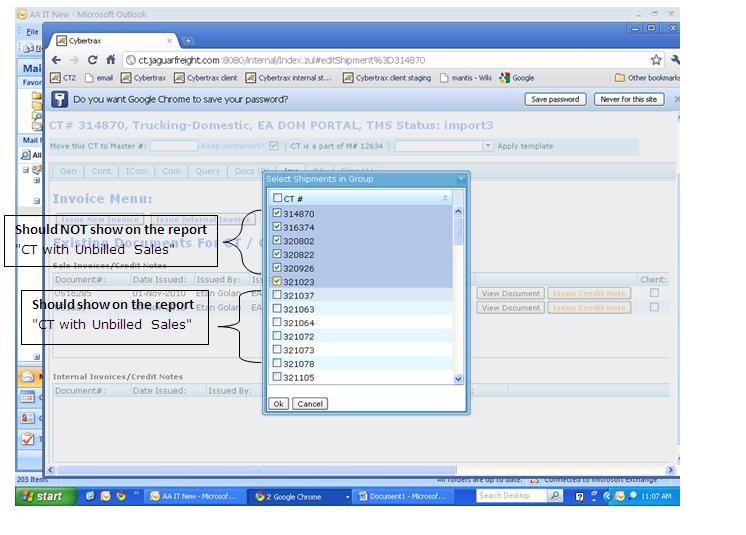

For Group Shipments:

Note: The system should recognize the CT records, that are included in the sales invoice

- Any CT records selected from the group, to be included on the invoice being issued, should NOT show on the report.

- Any CT records not selected from the group, to be included on the invoice being issued, SHOULD show on the report.

Note: For shipments on the report. The report should show the Jaguar Office that has entered to largest PI in an additional column on the report.

**PLEASE SEE ATTACHED EXAMPLES FOR FURTHER EXPLANATION**

“CT with a Loss”

Criteria: * If the Sales invoice exceeds the Purchase Invoice, the record should NOT show on the report.

- The shipment should not be considered "Billed complete", until the total Sales invoices is greater than the total Purchase invoices.

- If a record contains a Sales Invoice that is equal to or less then the Purchase Invoice, the record SHOULD show on the report.

**PLEASE SEE ATTACHED EXAMPLES FOR FURTHER EXPLANATION**

Reports should include the Jaguar Office reflecting the loss.

- If multiple offices show a loss or show purchase invoices without sales invoices – the office showing the largest loss should be the one included on the report.