2565 rfsa

From UG

(Created page with 'Category:Projects ==PARENT MANTIS== 0002515: [Estim P&L] .......<proj> ==REQUIREMENTS== Core: Enable accounting to “close out” the month end, at the actual end of eac…') |

|||

| (55 intermediate revisions not shown) | |||

| Line 1: | Line 1: | ||

| - | [[Category: | + | [[Category:Estimated P and L]] |

| - | == | + | == Info == |

| - | + | ||

| - | + | Mantis: 0002565: [Estim P&L] Implement phase 1 | |

| - | + | == Glossary == | |

| + | '''Gross Margin report''' - same as "P/L report". | ||

| - | ===Estimated Cost=== | + | '''Estimated Gross Margin''' = estimated sale minus estimated cost. |

| + | |||

| + | '''Actual Gross Margin''' = actual sale minus actual cost. | ||

| + | |||

| + | '''Point Of Revenue Recognition''' - Point in time (date) when "Sale" for shipment order (CT) is considered complete. It is MOT specific: | ||

| + | |||

| + | * For Ocean LCL and FCL Shipments this date is [[#Port Of Loading Actual Date]] | ||

| + | * For Air shipments this date is [[#Airport Of Departure Actual Date]] | ||

| + | * For Truck shipments this date is [[#Actual Export Pick Up Date]] | ||

| + | |||

| + | '''Month-end closing''' - an accounting procedure undertaken at the end of the month to close out that month. In the context of this project and our business it means '''to compile a "P/L" report that have all CTs with Point Of Revenue Recognition date falling within that month'''. To make this report meaningful estimated cost and sales numbers for every CT should be present. In this case we will see Estimated total cost, sale and Gross Margin for entire business. Margin will indicate how much money business made (or lost) that month. | ||

| + | |||

| + | == Requirements == | ||

| + | |||

| + | Core: Enable accounting to “close out” the month end, at the actual end of each month, based on estimated charges. In order to achieve this we will follow the below. | ||

| + | |||

| + | |||

| + | We need to give operators the ability the enter estimated costs and sale rates for each CT record. This information will be used for accounting to close the accounting books '''Month-end closing''' at the end of each month. | ||

| + | |||

| + | |||

| + | |||

| + | Estimation for freight charges: | ||

| + | *Pull the estimated sell rate from a database to be entered under the client profile (to be handled on phase 2) | ||

| + | **If nothing is in the database that matches the required information(TBA defined in Phase 2)the system should automatically calculate the estimated sell by: | ||

| + | ***Pull cost from a database (to also be handled in phase 2) and add 15% to it. The estimated sell should equal the total of the (cost x 15%)+ cost | ||

| + | **Work around for Phase one - Operators should manually enter cost. The sell should calculate automatically be based on the above calculation. | ||

| + | *Operators will need to be able to edit the costs and sell and cost or sell estimations manually. | ||

| + | *They should also be able to add and remove lines from the estimation. | ||

| + | Exception: | ||

| + | *Customs Cost's | ||

| + | **Charge Codes beginning with 12 should have no calculation. The sell should match the cost entered. (System should copy same number from cost to sales field). | ||

| + | **The operators should still be able to manually update the cost and sell and the cost or sell. | ||

| + | |||

| + | |||

| + | ====Estimated Cost==== | ||

should reflect: | should reflect: | ||

* Dollar Amount | * Dollar Amount | ||

| Line 16: | Line 50: | ||

* Charge Code | * Charge Code | ||

* Charge Code Description | * Charge Code Description | ||

| + | * Total of all estimated Cost entered should be shown | ||

| + | * Currency of the total estimated Cost should be shown | ||

| - | ===Estimated Sell=== | + | ====Estimated Sell==== |

should reflect: | should reflect: | ||

| - | |||

* Dollar amount | * Dollar amount | ||

* Currency | * Currency | ||

| + | * Charge Code | ||

| + | * Charge Code Description | ||

| + | * Total of all estimated sell entered should be shown | ||

| + | * Currency of the total estimated sell should be shown | ||

| + | |||

| + | |||

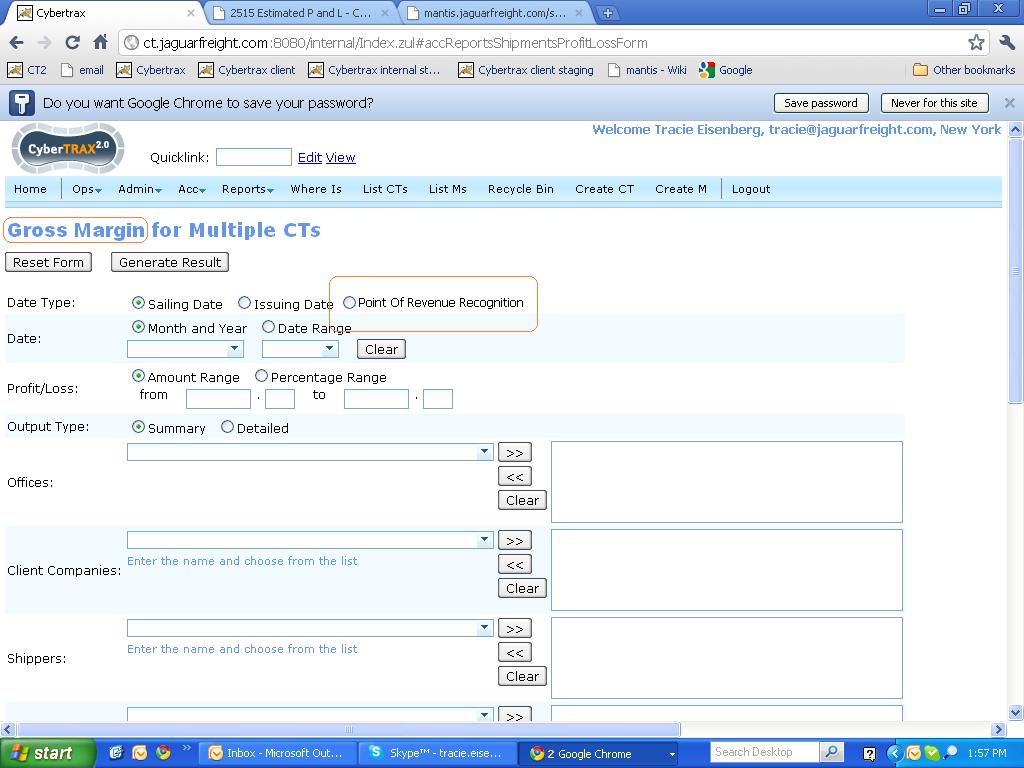

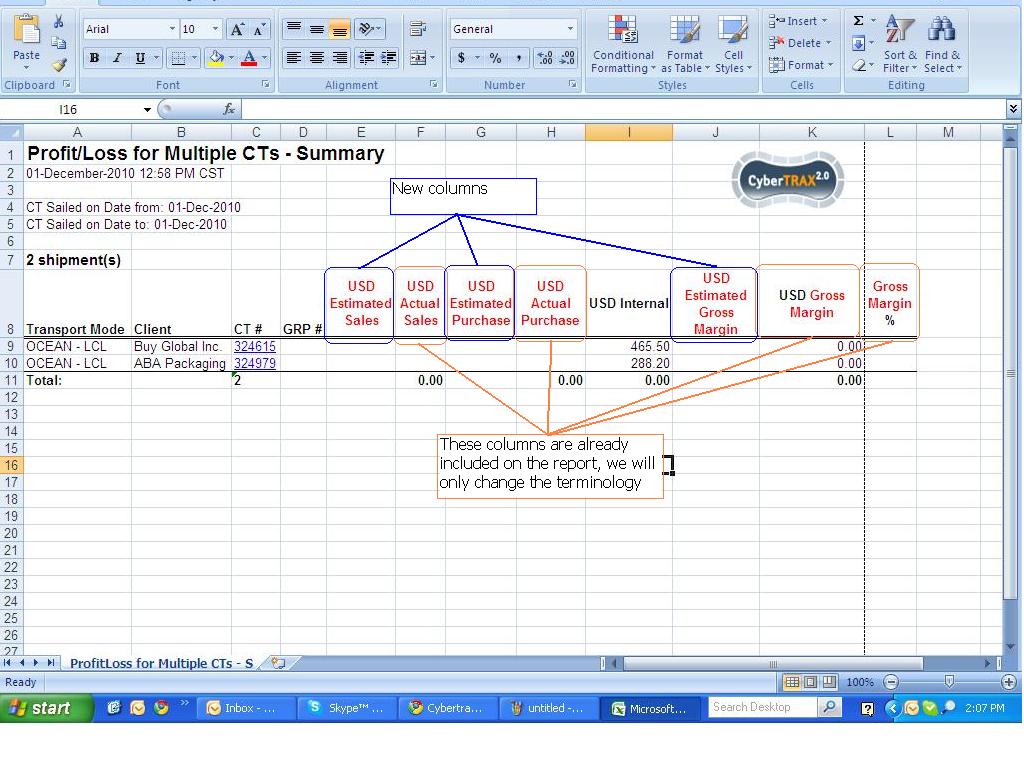

| + | ====Reports==== | ||

| + | *Should be able to generate a report showing both estimated cost/sell and actual cost/sell | ||

| + | *The report should be per CT record | ||

| + | *should be within a selected time frame | ||

| + | *should able to download to excel | ||

| + | |||

| + | [[File:Estimation Report.JPG]] | ||

| + | [[File:Report terms.JPG]] | ||

| + | |||

| + | ==== Dashboard ==== | ||

| + | New type of dashboard panel required. | ||

| + | |||

| + | It should show how many CT records passed Point Of revenue recognition AND are '''CT is not estimated'''. | ||

| + | |||

| + | '''CT is not estimated''' - grand total is 0 on EstTab. | ||

| + | |||

| + | ===== Dashboard visibility ===== | ||

| + | To identify which operator should have CT posted to this dashboard the following criteria must be met: | ||

| - | + | * CT records passed Point Of revenue recognition AND | |

| + | * ''CT is not estimated'' AND | ||

| + | * operator belongs to the office that handles the specified region: | ||

| + | ** [[Ct#Airport_Of_Destination]]/[[Ct#Destination_Terminal]]/[[Ct#Export_Delivery_To_Address]] belongs to the region defined in ''Geography>Regions>Office field'' for this given operator | ||

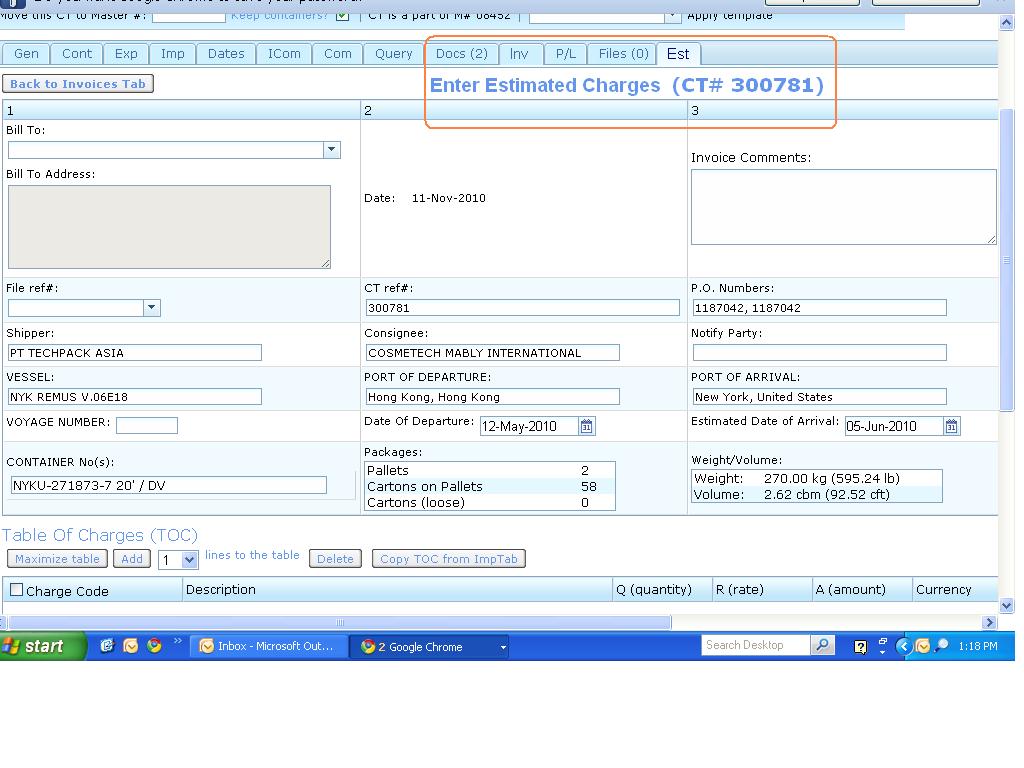

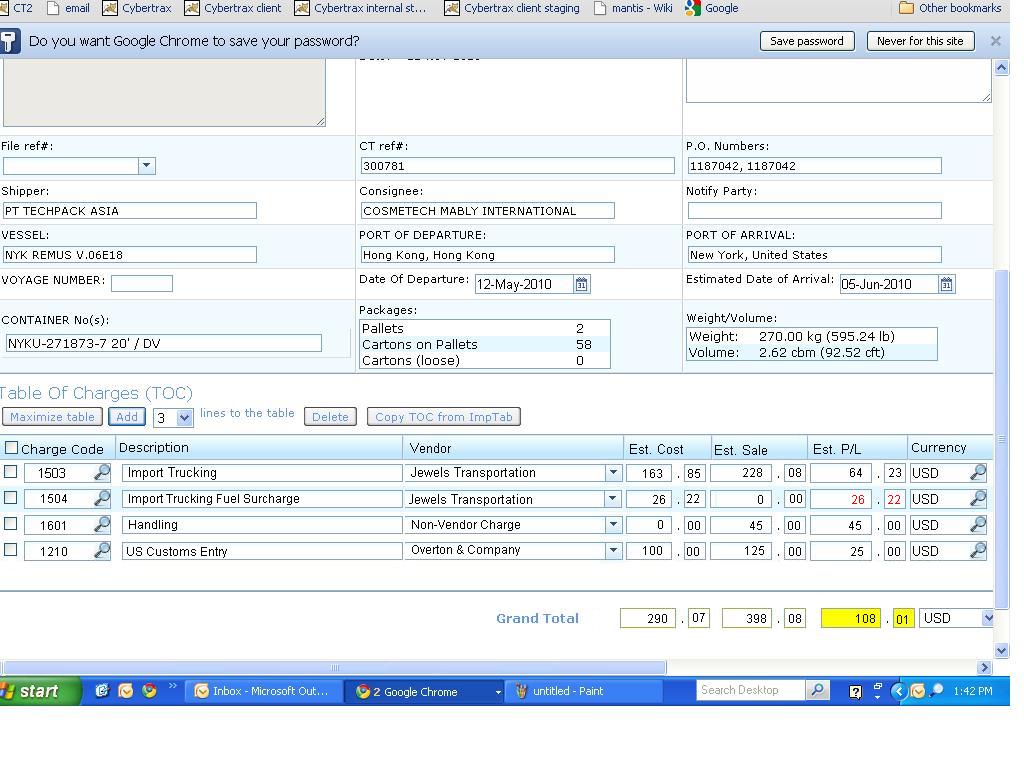

| - | + | ====DESIGN IDEAS==== | |

| - | + | These charges will be entered in on a separate Tab Est., as per examples below | |

| + | Once these charges are entered – It should then pull through and show on the P/L tab.. | ||

| - | |||

| + | The difference between actual and estimation should be easily identified (by example attached maybe using a lighter color) | ||

| - | + | [[File:Enter estimated charges on tab.JPG]] | |

| + | [[File:Estimation calculated.JPG]] | ||

| + | [[File:Pl estimation screen.JPG]] | ||

Current revision as of 18:16, 13 February 2012

Contents |

[edit] Info

Mantis: 0002565: [Estim P&L] Implement phase 1

[edit] Glossary

Gross Margin report - same as "P/L report".

Estimated Gross Margin = estimated sale minus estimated cost.

Actual Gross Margin = actual sale minus actual cost.

Point Of Revenue Recognition - Point in time (date) when "Sale" for shipment order (CT) is considered complete. It is MOT specific:

- For Ocean LCL and FCL Shipments this date is #Port Of Loading Actual Date

- For Air shipments this date is #Airport Of Departure Actual Date

- For Truck shipments this date is #Actual Export Pick Up Date

Month-end closing - an accounting procedure undertaken at the end of the month to close out that month. In the context of this project and our business it means to compile a "P/L" report that have all CTs with Point Of Revenue Recognition date falling within that month. To make this report meaningful estimated cost and sales numbers for every CT should be present. In this case we will see Estimated total cost, sale and Gross Margin for entire business. Margin will indicate how much money business made (or lost) that month.

[edit] Requirements

Core: Enable accounting to “close out” the month end, at the actual end of each month, based on estimated charges. In order to achieve this we will follow the below.

We need to give operators the ability the enter estimated costs and sale rates for each CT record. This information will be used for accounting to close the accounting books Month-end closing at the end of each month.

Estimation for freight charges:

- Pull the estimated sell rate from a database to be entered under the client profile (to be handled on phase 2)

- If nothing is in the database that matches the required information(TBA defined in Phase 2)the system should automatically calculate the estimated sell by:

- Pull cost from a database (to also be handled in phase 2) and add 15% to it. The estimated sell should equal the total of the (cost x 15%)+ cost

- Work around for Phase one - Operators should manually enter cost. The sell should calculate automatically be based on the above calculation.

- If nothing is in the database that matches the required information(TBA defined in Phase 2)the system should automatically calculate the estimated sell by:

- Operators will need to be able to edit the costs and sell and cost or sell estimations manually.

- They should also be able to add and remove lines from the estimation.

Exception:

- Customs Cost's

- Charge Codes beginning with 12 should have no calculation. The sell should match the cost entered. (System should copy same number from cost to sales field).

- The operators should still be able to manually update the cost and sell and the cost or sell.

[edit] Estimated Cost

should reflect:

- Dollar Amount

- Vendor

- Currency

- Charge Code

- Charge Code Description

- Total of all estimated Cost entered should be shown

- Currency of the total estimated Cost should be shown

[edit] Estimated Sell

should reflect:

- Dollar amount

- Currency

- Charge Code

- Charge Code Description

- Total of all estimated sell entered should be shown

- Currency of the total estimated sell should be shown

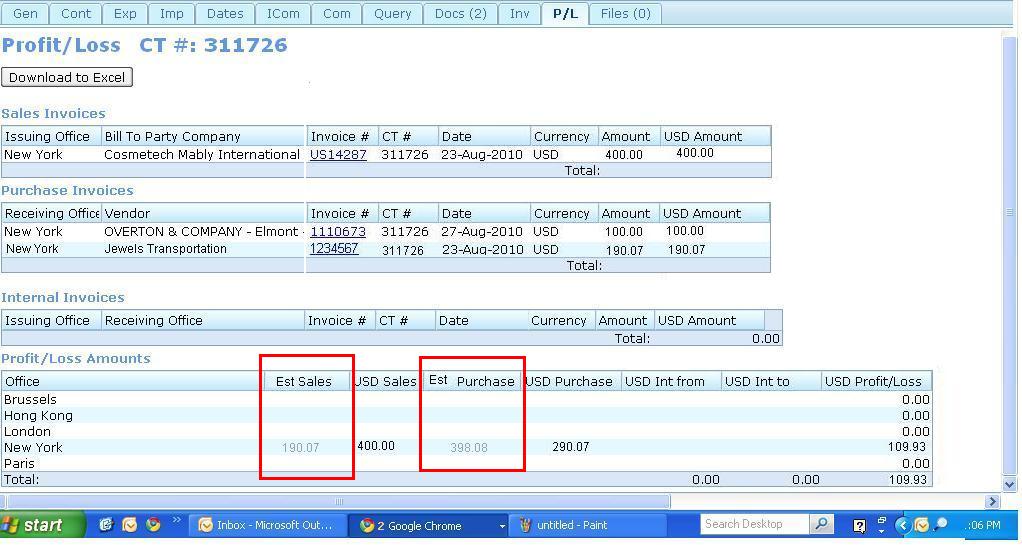

[edit] Reports

- Should be able to generate a report showing both estimated cost/sell and actual cost/sell

- The report should be per CT record

- should be within a selected time frame

- should able to download to excel

[edit] Dashboard

New type of dashboard panel required.

It should show how many CT records passed Point Of revenue recognition AND are CT is not estimated.

CT is not estimated - grand total is 0 on EstTab.

[edit] Dashboard visibility

To identify which operator should have CT posted to this dashboard the following criteria must be met:

- CT records passed Point Of revenue recognition AND

- CT is not estimated AND

- operator belongs to the office that handles the specified region:

- Ct#Airport_Of_Destination/Ct#Destination_Terminal/Ct#Export_Delivery_To_Address belongs to the region defined in Geography>Regions>Office field for this given operator

[edit] DESIGN IDEAS

These charges will be entered in on a separate Tab Est., as per examples below

Once these charges are entered – It should then pull through and show on the P/L tab..

The difference between actual and estimation should be easily identified (by example attached maybe using a lighter color)