Acc Etc

From UG

(→Freight Invoice Section On Arrival Notice) |

(→Restriced Accounting Access) |

||

| Line 68: | Line 68: | ||

Currency and Exchange Rates - All Aspects (except viewing) | Currency and Exchange Rates - All Aspects (except viewing) | ||

| - | Unit Types - All Aspects | + | Unit Types - All Aspects - '''This is not being used in the system currently. --[[User:Denise|Denise]] 09:08, 21 November 2011 (EST) See [[]] |

Charge Codes - All Aspects | Charge Codes - All Aspects | ||

Purchase invoices - deleting | Purchase invoices - deleting | ||

| - | |||

=== Mid Level Accounting Access === | === Mid Level Accounting Access === | ||

Revision as of 14:08, 21 November 2011

Contents |

Info

This mantis contains bits an pieces related to accounting:

- #Freight Invoice Section On Arrival Notice

- #Acc Access Levels

- #Address Book Bill To Tab

- #Acc Client Profile

Freight Invoice Section On Arrival Notice

Business Needs and Requirements

This section will serve as an invoice to a broker who in turn will bill a customer.

Still operator will issue Sales Invoice (through the Invoice Tab) with the same set of charges. He can do it because Import tab "remembers" charges.

Invoice is issued for 2 reasons:

- to enter charges into Jaguar accounting system (QuickBooks in NY) we need "invoice number" and Arrival Notice does not have invoice number

- same as above on a side of a customer

??? Potential for error! operator can edit TOC on template. Also can edit Import Tab TOC after these charges have been printed on Arrival Notice.

Who is using:

- This is often used in France

- Phi for Basic Fun

- This is an amendment to Arrival Notice Air and Ocean.

- There is an optional section on these 2 documents.

- see Fig File:Freight_Invoice_Template.JPG

Table Of Charges

- Description:

- Imp Tab.TOC.lineX.CC Descr

- Currency:

- Imp Tab.TOC.lineX.Curr

- Amount:

- Imp Tab.TOC.lineX.Amount

- (alex: why editable??? Simon: for now keep it as is )

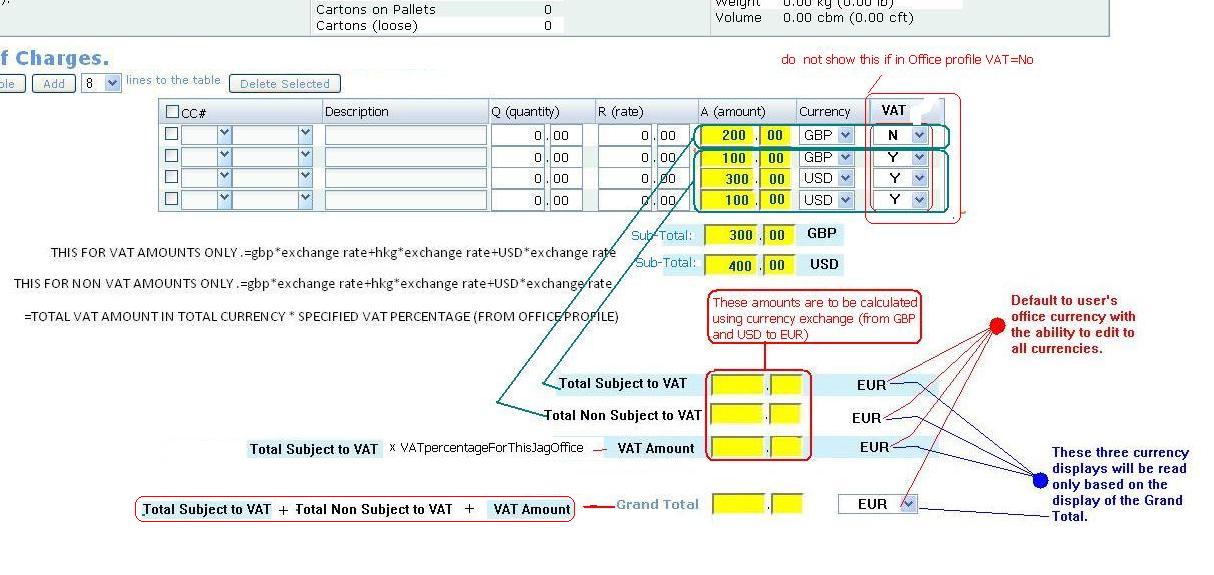

- Totals - should display all totals and VAT lines as on Imp Tab:

- Sub-Total (in every currency used)

- Total Subject to VAT (in Grand Total currency)

- Total Non Subject to VAT (in Grand Total currency)

- VAT Amount (in Grand Total currency)

- Grand Total, read only

- checkbox:

- if checked then Do not print Table Of Charges

! See also Arrival_Notice_Air

Acc Access Levels

Restriced Accounting Access

Credit Holds

Currency and Exchange Rates - All Aspects (except viewing)

Unit Types - All Aspects - This is not being used in the system currently. --Denise 09:08, 21 November 2011 (EST) See [[]]

Charge Codes - All Aspects

Purchase invoices - deleting

Mid Level Accounting Access

Entering and Editing Vendor/Customer

Approving Credit notes

Add Credit Facilities in CT

Currency and Exchange Rates - viewing

Non- Restriced Accounting Access

Purchase invoices - adding, editing

Reports - all aspects

Address Book Bill To Tab

Display Exchange Rates Checkbox

- Display exg rates or not on Sales invoice

(todo: explain....)

Acc Client Profile

Business Requirements

We need to maintain a number of accounting related parameters in Client Company profile.

Credit Terms:

- Credit terms are the time limits you set for your customers' promise to pay for their merchandise or services received. (in number of days)

Credit Status:

- (low, severe, etc)

Credit Limit:

- Sales invoice total ??? (in USD)

Depending on values above system would take appropriate action after operator creates CT/M for given client.

This is "Acc Info" section of Client Profile.

Path: Admin > Clients > Acc Info

Version 2.0

1) Dropdowns "credit status", "cr limit", "cr terms" need to be managed through Admin

2) Add functionality related to "credit status", "cr limit", "cr terms": if bad credit status then CT must be approved by manager.

VAT

Business Needs and Requirements

Systems Design

Summary

User Interface and Functionality

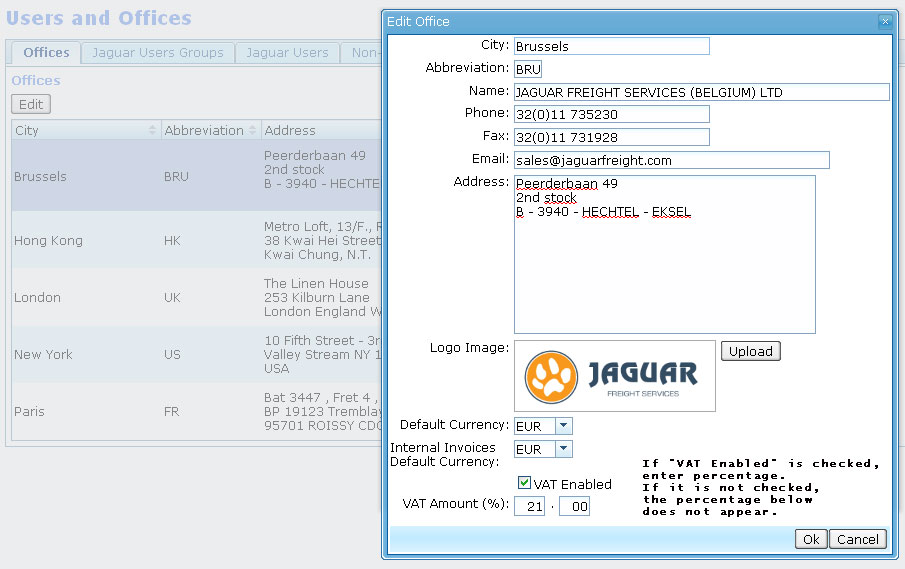

VAT option for office profile

- "VAT Enabled" checkbox

- "VAT Amount (%)" textfield

- see Figure 1

TOC with VAT on Sales Inv / Imp Tab

- IF logged in user is from Office where VAT=Y

- THEN TOC on Sales Invoice / Imp Tab should have VAT related features on it

- see Figure 2

- this table is used in:

- Sales Invoice

- Freight Invoice (amendment to Arrival Notice)