1520 rfsa

From UG

(Difference between revisions)

| (8 intermediate revisions not shown) | |||

| Line 5: | Line 5: | ||

==Info== | ==Info== | ||

| - | 0001520: (P&L) | + | 0001520: (P&L) shown VAT amount on P/L tab |

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| + | It is necessary for the operators to have visibility of the VAT amounts in the P/L screen. This should be for both Sales invoices and Purchase invoices. | ||

==Business Requirements== | ==Business Requirements== | ||

We need to add a column in the P/L tab showing the VAT charges of the invoice. | We need to add a column in the P/L tab showing the VAT charges of the invoice. | ||

| - | |||

| - | *for purchase invoices the total | + | *for Sales invoices the total VAT listed on the invoice should be shown in this column. |

| + | |||

| + | *for purchase invoices the total VAT entered into this tab under charge code 1204 should be shown in this column. | ||

*for internal invoices VAT should not apply. | *for internal invoices VAT should not apply. | ||

| - | * | + | *No changes should be made to the profit loss section of this tab. |

| - | Only the London and Paris offices have the drop down selection to select if VAT applies to a charge, but we need this column to be viewed by all offices. | + | Only the London and Paris offices have the drop down selection to select if VAT applies to a specific charge, but we need this column to be viewed by all offices. |

Note: In the future, we will want to be able to run reports showing this information and we may also need a way to show Customs Duty separately | Note: In the future, we will want to be able to run reports showing this information and we may also need a way to show Customs Duty separately | ||

| - | Examples: | + | ===Examples:=== |

| + | |||

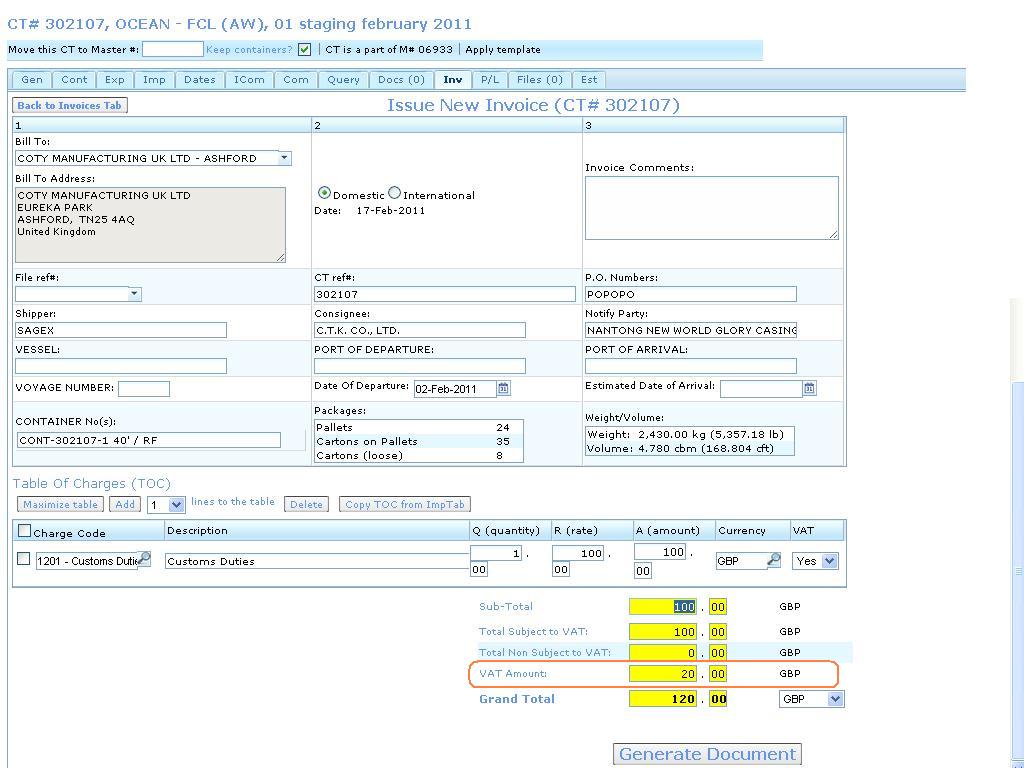

| + | '''SALES INVOICE SCREEN:''' | ||

[[File:Invoice VAT.JPG]] | [[File:Invoice VAT.JPG]] | ||

| + | |||

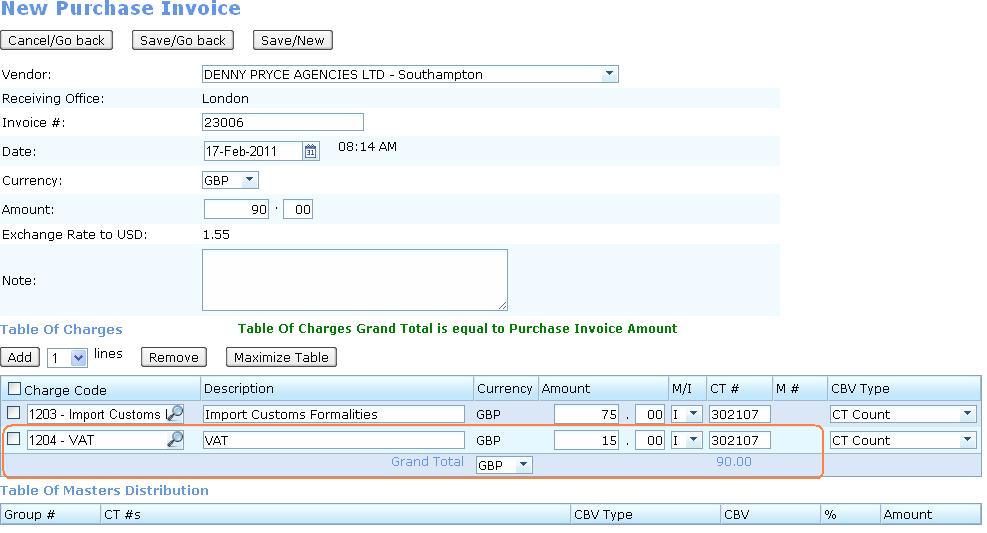

| + | '''PURCHASE INVOICE SCREEN:''' | ||

| + | |||

[[File:Purchase invoice with VAT.JPG]] | [[File:Purchase invoice with VAT.JPG]] | ||

| - | [[File:Pl screen shot with VAT column.JPG]] | + | |

| + | |||

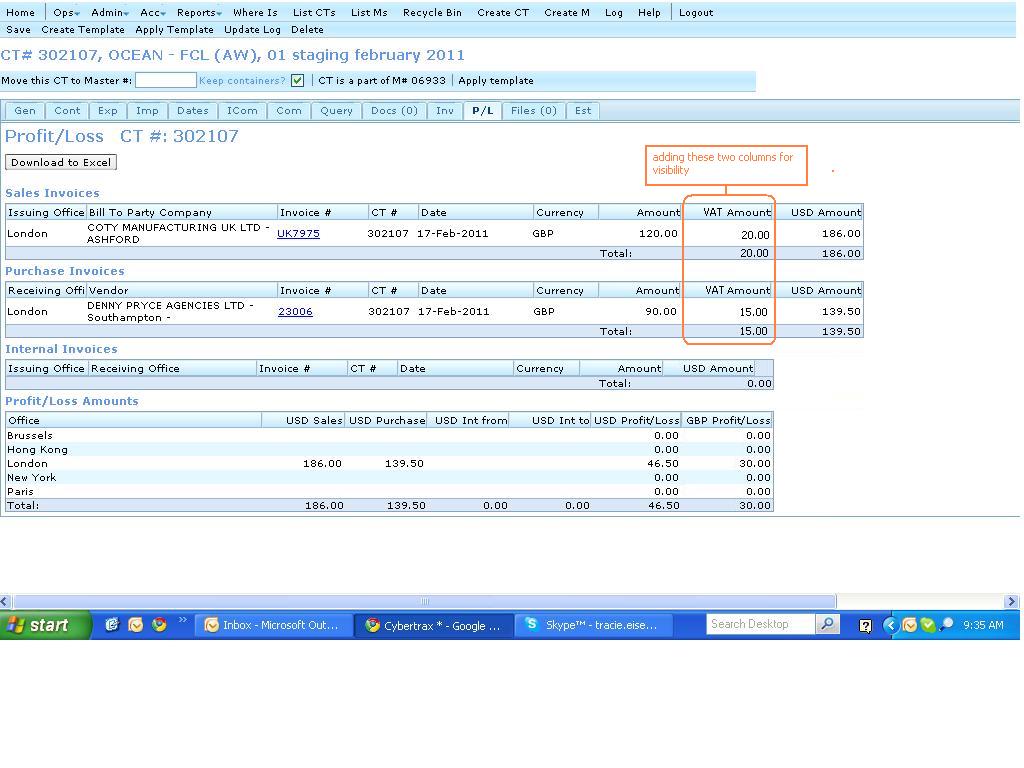

| + | '''P/L TAB:''' | ||

| + | |||

| + | [[File:Pl screen shot with VAT column updated.JPG]] | ||

| + | |||

| + | |||

</div> | </div> | ||

Current revision as of 15:54, 17 February 2011

[edit] Info

0001520: (P&L) shown VAT amount on P/L tab

It is necessary for the operators to have visibility of the VAT amounts in the P/L screen. This should be for both Sales invoices and Purchase invoices.

[edit] Business Requirements

We need to add a column in the P/L tab showing the VAT charges of the invoice.

- for Sales invoices the total VAT listed on the invoice should be shown in this column.

- for purchase invoices the total VAT entered into this tab under charge code 1204 should be shown in this column.

- for internal invoices VAT should not apply.

- No changes should be made to the profit loss section of this tab.

Only the London and Paris offices have the drop down selection to select if VAT applies to a specific charge, but we need this column to be viewed by all offices.

Note: In the future, we will want to be able to run reports showing this information and we may also need a way to show Customs Duty separately

[edit] Examples:

SALES INVOICE SCREEN:

PURCHASE INVOICE SCREEN:

P/L TAB: