2157 dev

From UG

(→Info) |

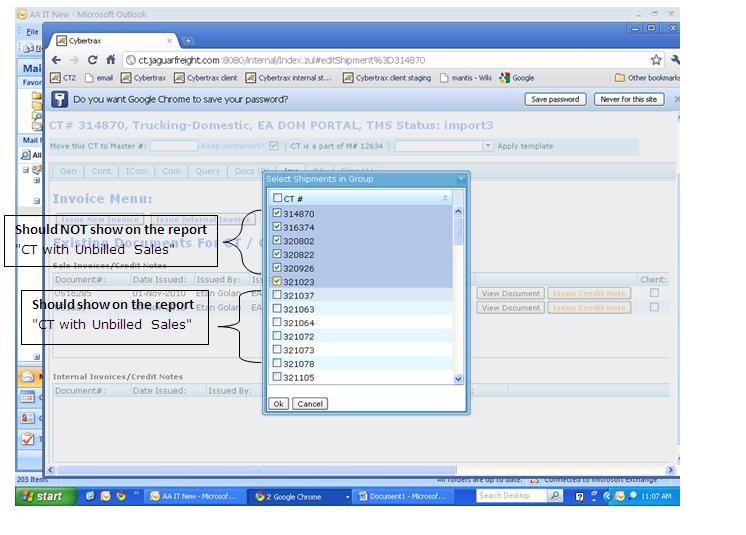

(→“CT with Unbilled Sales”) |

||

| Line 21: | Line 21: | ||

*If no Purchase Invoice is issued against the CT record, the shipment should NOT show on the report. | *If no Purchase Invoice is issued against the CT record, the shipment should NOT show on the report. | ||

| - | |||

Notes: | Notes: | ||

Revision as of 19:56, 10 December 2010

Contents |

Info

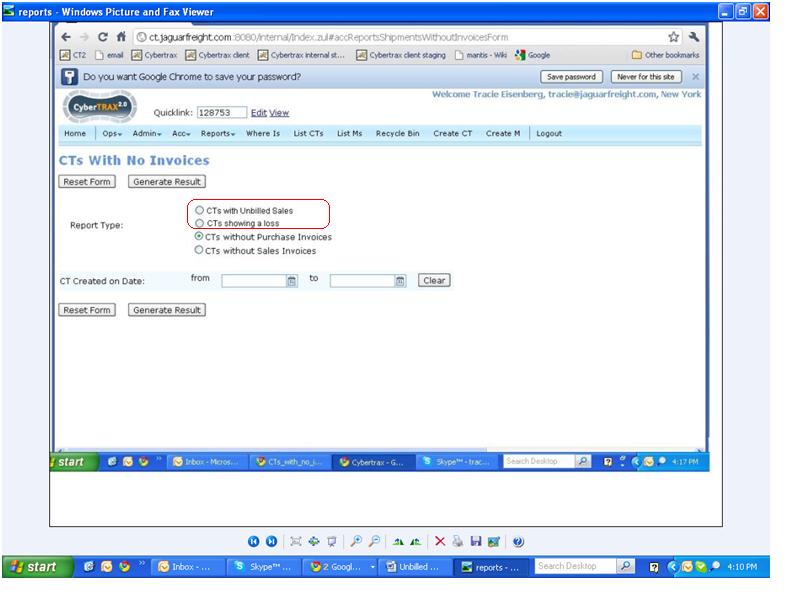

This is a tweak for the following Acc component: Acc Reports CTs With No Inv

We need to create a report that would allow accounting to monitor that shipments are being invoiced in a timely manner and with a profitable gross margin.

Requirements

Adding two additional report types.

“CT with Unbilled Sales”

Criteria: CT should appear on this report if:

CT record with no sales invoice issued.

AND

There is Purchase invoice issued against the CT record greater then $0.00.

- If no Purchase Invoice is issued against the CT record, the shipment should NOT show on the report.

Notes:

The system should not recognize internal invoices as a sales invoice for this report.

For group shipments, the system should recognize the CT records group that are included in the sales invoice.

For shipments on the report. The report should show the Jaguar Office that has entered to largest PI in an additional column on the report.

“CT with a Loss”

Criteria: * If the Sales invoice exceeds the Purchase Invoice, the record should NOT show on the report.

- The shipment should not be considered "Billed complete", until the total Sales invoices is greater than the total Purchase invoices.

- If a record contains a Sales Invoice that is equal to or less then the Purchase Invoice, the record SHOULD show on the report.

**PLEASE SEE ATTACHED EXAMPLES FOR FURTHER EXPLANATION**

Reports should include the Jaguar Office reflecting the loss.

- If multiple offices show a loss or show purchase invoices without sales invoices – the office showing the largest loss should be the one included on the report.